Trustee, Custody and Debt services powered by industry expertise, passion and pragmatism.

Combining industry expertise and leading technology, we work with you to reimagine and optimise how financial products and funds operate in a dynamic, highly regulated environment.

Find out moreOur complete services offering

Certane provides a full range of custody and trustee services, partnering with our clients to create solutions to streamline operations, improve governance and allow them to focus on product innovation, asset management and growth. We have deep experience in the following areas:

Custody and Corporate Trust Services

Employee Share Plans

Trustee services for employee share plans, including listed and unlisted shares.

Talk to our experts today to learn more about our trustee services and how we can help you launch and grow your fund.

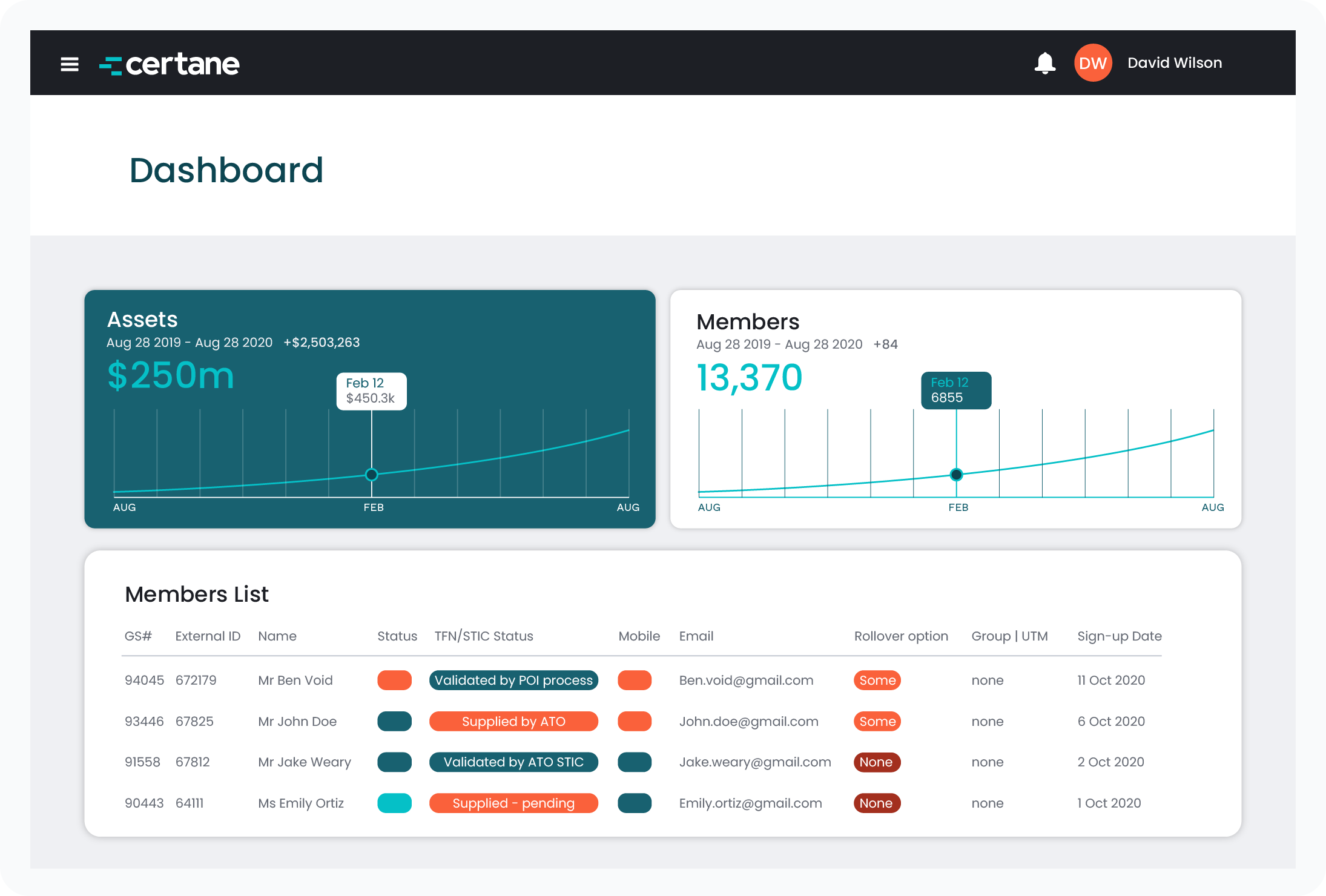

Our technology solutions

Our technology-led services and infrastructure provide operational efficiency and scalability for our clients.

Why choose Certane?

We work with clients to improve the efficiency, transparency and success of financial products and funds in a dynamic, highly regulated environment. Our team of experts are committed to ensuring the best for our clients, providing innovative solutions to ensure the best outcomes.

We understand that speed to market, reliability, support and flawless execution are critical for a successful engagement.

Our clients

We work with over 200 companies including responsible entities, trustees, limited partnerships and financial institutions. We have experience across a wide range of product types and asset classes.

- Superannuation funds

- Real estate funds

- Private debt funds

- Private equity funds

- Infrastructure funds

- Equity funds

- Employee share plan trusts

- Agricultural funds

- Cash funds

- Fixed interest funds

- Fund of funds

- Mortgage funds

- Peer-to-peer lending

- Significant investors visa